Monday, December 31, 2018 Thursday, December 27, 2018 Friday, December 21, 2018 Tuesday, December 18, 2018 Tuesday, December 11, 2018 Tuesday, December 4, 2018 Tuesday, November 27, 2018 Wednesday, November 21, 2018 Friday, November 16, 2018 Tuesday, November 13, 2018 Tuesday, November 6, 2018 Tuesday, October 30, 2018 Tuesday, October 23, 2018 Thursday, October 18, 2018 Tuesday, October 16, 2018 Tuesday, October 9, 2018 Tuesday, October 2, 2018 Tuesday, September 25, 2018 Tuesday, September 18, 2018 Tuesday, September 11, 2018 Tuesday, September 4, 2018 Tuesday, August 28, 2018 Tuesday, August 21, 2018 Tuesday, August 14, 2018 Tuesday, August 7, 2018 Thursday, August 2, 2018 Tuesday, July 24, 2018 Friday, July 20, 2018 Tuesday, July 17, 2018 Tuesday, July 10, 2018 Tuesday, July 3, 2018 Tuesday, June 26, 2018 Tuesday, June 19, 2018 Friday, June 15, 2018 Tuesday, June 12, 2018 Tuesday, June 5, 2018 Tuesday, May 29, 2018 Tuesday, May 22, 2018 Friday, May 18, 2018 Tuesday, May 15, 2018 Tuesday, May 8, 2018 Tuesday, May 1, 2018 Tuesday, April 24, 2018 Friday, April 20, 2018 Tuesday, April 17, 2018 Tuesday, April 10, 2018 Tuesday, April 3, 2018 Monday, March 26, 2018 Tuesday, March 20, 2018 Friday, March 16, 2018 Tuesday, March 13, 2018 Tuesday, March 6, 2018 Tuesday, February 27, 2018 Monday, February 19, 2018 Friday, February 16, 2018 Tuesday, February 13, 2018 Tuesday, February 6, 2018 Tuesday, January 30, 2018 Tuesday, January 23, 2018 Friday, January 19, 2018 Wednesday, January 17, 2018 Tuesday, January 9, 2018 Tuesday, January 2, 2018 About UsCareersBoard of DirectorsCommunity ImpactADA/ Web Accessibility CloseEnuff™ CheckingSavings AccountsMoney MarketsCertificates of DepositIRAsGrow Your Change Auto LoansBoat & RV LoansPersonal LoansBusiness LoansHome Equity LoansStudent LoansSkip-A-Pay PurchaseRefinanceFirst-Time HomebuyersMortgage Specialists Credit CardsCard Info & DisclosuresFraud Protection Youth ServicesStudent-Run CUGreenlightYoung Adult ServicesScholarshipsCloseEnuff™ Student Checking Community ImpactRelentless Care FoundationChoose The BearBlog Archive

Happy New Year! Now is a great time to establish goals that you want to reach during the year. If you’re looking for some resolutions to improve your personal finances, we’re pleased to offer some tips to get you on the right track this year.

Happy New Year! Now is a great time to establish goals that you want to reach during the year. If you’re looking for some resolutions to improve your personal finances, we’re pleased to offer some tips to get you on the right track this year.

1. Tune your budget

It’s great to start off the new year with a plan. A budget is a plan that starts with the income you expect and your fixed expenses such as your mortgage or rent, insurance, and utilities. The plan incorporates your savings goals, and the remaining money is designated for your other expenses. A realistic budget will help you set your financial goals and will remind you to stick to them. Now is the perfect time to assess last year’s budget or create a new one if you don’t yet have one in place.

But now, the party’s over. You’ve woken up into adulthood and realized that all that overspending is going to cost you big—and it’s going to cost for years to come. Luckily, there’s hope. It’s not too late to fix the financial mistakes we all make when we’re young and blissfully ignorant. Here are six of the most common mistakes people make while in their 20's and how to fix them:

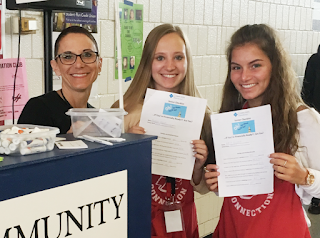

At our partnering high schools in the Plymouth-Canton community (P-CEP, Starkweather Academy, New School High, and Canton Preparatory High School), Community Financial is busy preparing students for the real world!

Education Partnership Coordinator, Kristen La Forest,

instructs teens about the "Ten Things Teens Should

Know About Credit" at Starkweather Academy.

Our high school Education Partnership Coordinator, Kristen La Forest, conducts presentations to help teens become more knowledgeable about financial topics and to ready them for the world beyond high school. One of her most requested presentations is “Ten Things Teens Should Know About Credit,” a 50 minute lesson where students learn the basics of credit card use, credit scores, and credit card fraud.

Check out our handy list of ways you can make the holidays count while still getting some of that much-needed rest and relaxation you’ve been craving all semester. You can still get your beauty rest and sleep in, only not until noon – well, at least not every day.

1. Phishing emails

Phishing scams abound ahead of the holidays. They can take the form of bogus delivery confirmation requests seeking your information or even a personalized letter to your child from “Santa.” Never share personal information online with an unverified source.

The winter months put extra strain on families and some are forced to choose between paying utilities and putting food on the table. Community Financial remains dedicated to supporting the fight against cold and hunger in Michigan each winter.

1. Look left

When looking at a menu, most people’s eyes drift to the right. Restaurants know this and purposely put their most expensive items on the right side of the menu. Check out the left side of the menu for cheaper options, or appetizers that can make a full meal, before looking right.

Set a Budget

Start by creating a budget that works with your plan and your wallet. Write a list of all the people you want to buy for and set a dollar amount for each person. Don’t forget smaller items such as stocking stuffers. If you think you will overspend with credit cards alone, consider using cash to stay within your budget.

Community Financial is excited for our first year in partnership with Grand River Academy in Livonia! Partnering with Grand River Academy marked Community Financial’s 50th Student-Run Credit Union! Our Student-Run Credit Union program provides students with a fun way to learn real-life skills. Each student who would like to volunteer to work at the Student-Run Credit Union will go through an interviewing process similar to what adults experience. Grand River Academy’s fifth and seventh grade students recently learned how the interviewing process works.

Education Partnership Coordinator, Amy Pashukewich,

instructs potential student hires on how to conduct

themselves in an interview setting.

Our Education Partnership Coordinators first teach students the importance of filling out an application in their best handwriting, dressing well for an interview, smiling and making eye contact. First impressions are incredibly important, and students are given the opportunity to practice these skills at a young age! Here are Grand River Academy’s very first potential “hires!”

???

Community Financial is proud to partner with Moraine Elementary in Northville for our 18th year in partnership! The students at Moraine participate in our Student-Run Credit Union program, which helps them learn and develop money management skills.

Moraine Elementary Student-Run Credit

Union fall volunteers!

Selected fourth grade students are “hired” and learn the business of banking as credit union tellers, branch managers, marketing representatives, computer operators and accountants. Moraine students are future leaders in the making!

Kristen La Forest, our high school Education Partnership Coordinator, created a “Senior Checklist” for 12th grade Advanced Marketing students this past school year at the Plymouth-Canton Educational Park. She interacted with these students as they ran our credit unions at P-CEP. This checklist ensured students were financially ready for the world of credit cards, credit scores, savings and checking accounts.

Kristen La Forest, our high school Education Partnership Coordinator, created a “Senior Checklist” for 12th grade Advanced Marketing students this past school year at the Plymouth-Canton Educational Park. She interacted with these students as they ran our credit unions at P-CEP. This checklist ensured students were financially ready for the world of credit cards, credit scores, savings and checking accounts.

High School Partnerships Lead Teens to Financial Success and Away From Fraud!

High School Partnerships Lead Teens to Financial Success and Away From Fraud!

Community Financial has exceptional partnerships with high schools in the Plymouth-Canton area. We are partners with P-CEP, Starkweather Academy, Canton Preparatory High School, and New School High. We have also conducted presentations at Northville High School and Clarenceville High School.

Education Partnership Coordinator, Kristen La Forest, runs our high school partnerships and prepares high school students for financial success. Mrs. La Forest creates and gives presentations to high school students on topics such as fraud, credit, credit scores, checking accounts, interviewing techniques, financial aid, etc. She is a wonderful resource for high school students just beginning to explore and navigate the financial world! Here are some pictures of Mrs. La Forest presenting the topic “Teens and Fraud” to students at Starkweather High School.

Education Partnership Coordinator, Angela Corbin,

posing with her Lewiston Elementary Spring Volunteers.Student-Run Credit Unions in the North!

Community Financial has school partnerships in five schools near our northern branches. Students in Gaylord Intermediate, Lewiston Elementary, Atlanta, Gaylord St. Mary’s, and Hillman Intermediate schools participate in our Student-Run Credit Union program.

Our Education Partnership Coordinator, Angela Corbin, works with schools in these areas to help educate the youth in northern Michigan. Here are some pictures of Angela with her student volunteers at Lewiston Elementary School!

Thornton Creek Students Lead with Parent Support!

Community Financial has continued to grow its Student-Run Credit Union program since it began in 1990. Thornton Creek Elementary School, in Northville, was an added partnership in 2004. Since then, the Thornton Creek “Gators” have been expert savers!

Education Partnership Coordinator,

Karie Gonczy, poses with one

of her branch managers.

Fourth grade volunteers run the Student Credit Union at Thornton Creek, and parents like to get involved too! With the high volume of student savers at Thornton Creek, parent helpers are a welcomed asset to the program. Parent helpers assist students in counting money, record keeping, and professionalism. Education Partnership Coordinator, Karie Gonczy, assists students and parent helpers in having an exceptional experience!

Check out these photos of some of our amazing parent helpers!

Seventh and eighth grade Life Management classes from Liberty Middle School in Canton participate in Mad City Money. This program is a reality simulation designed to engage students in making tough budgeting choices as if they were an adult. Students begin the simulation by picking a profession and are given a set salary.

Life Management teacher, Colleen Ramirez, helps students

make wise choices at the Mad City Money “Mall” station.

They are also given credit card debt, student loan payments, and healthcare costs. During the simulation, students must purchase their transportation, housing, child care, home essentials, food, and clothing within their means. In the end, the goal is for students to have built a monthly budget that leaves $100 in their checking account.

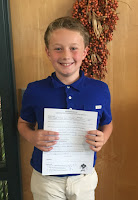

Even though Webster Elementary School is only in its third year of partnership with our Student-Run Credit Union program, the students at this elementary school in Livonia are already learning valuable, transferable work skills. Every student that would like to volunteer at our Student-Run Credit Union branch must fill out a job application and participate in a job interview.

A Webster 5th grade student

(dressed for success) posing with

his completed job application!

Our Education Partnership Coordinators teach students the importance of filling out their applications legibly, truthfully, and accurately. Some students at Webster even turn in attached resumes with their job applications! There are some amazing students at Webster Elementary!

P.O. Box 8050

Plymouth, Michigan 48170-8050

(877) 937-2328

2021(61)

December(5)

November(6)

October(5)

September(4)

August(5)

July(3)

June(6)

May(5)

April(5)

March(6)

February(6)

2020(61)

December(6)

All You Need to Know About Going Cashless5 Ways to Trim Your Fixed ExpensesBeware of Debt-Collection ScamsSchool Spotlight: Liberty Middle School and Financial Online Resources for Middle School Students3 Ways to Make Your Holidays Bright (and Safe!)9th Annual Warming Hearts & Homes: You Click, We Donate!

November(5)

October(5)

September(5)

August(4)

July(4)

June(6)

The Complete Guide to Prioritizing Bills During a Financial CrunchAll You Need to Know About Closing CostsSchool Spotlight: New School High Learns Real-Life Skills with the Student-Run Credit Union ProgramCreative Dine-In Cooking: Spaghetti PizzaWhy Is There Still a Shortage on Some Goods?Summer of Sharing 2020: 10 Years of Sharing

May(5)

April(5)

March(6)

February(5)

2019(62)

December(6)

Using 20/20 Vision in Your Financial New Year's ResolutionsStay Safe From These Airbnb Scams This WinterHow to Prepare Your Home for WinterSchool Spotlight: Bentley Elementary Students Benefit with the Student-Run Credit Union and Junior Achievement Programs6 Ways to Keep Your Finances Intact This Holiday SeasonWarming Hearts & Homes is Back. You Click. We Donate!

November(6)

October(6)

Save Money by Dining In | Butternut Squash and Chicken Chili5 Apps to Download Before the Holiday Shopping SeasonSchool Spotlight: Ridge Wood Elementary Teachers Engage Students in Financial EducationInternational Credit Union Day is October 17th!Making Banking Easier with an Updated Mobile App!Ways to Save on Food Costs in College

September(4)

August(4)

July(5)

June(5)

May(5)

April(6)

March(5)

February(5)

2018(63)

December(6)

4 Financial Resolutions for 2019 6 Financial Mistakes People Make in their 20's and How to Fix ThemSchool Spotlight: Local High School Students Learn About CreditMaking the Holidays Count When Home from College7 Naughty Scams to Watch Out for During the HolidaysWarming Hearts & Homes is Back. You Click. We Donate!

November(5)

October(6)

September(4)

August(5)

July(5)

June(5)

May(6)

April(5)

March(5)

February(5)

4 Financial Resolutions for 2019

6 Financial Mistakes People Make in their 20's and How to Fix Them

Like many people, you may have blown through your 20's making financial decisions that served you well in the moment, but were not the most responsible. Dinner out several times a week, credit card bills you barely looked at, and luxury cars way beyond your budget—life was practically a party!

School Spotlight: Local High School Students Learn About Credit

Making the Holidays Count When Home from College

Are you a college student that’s home for the holidays or know one that is? Don’t spend your break sleeping in until noon and letting the time slip through your fingers with nothing to show for it.

7 Naughty Scams to Watch Out for During the Holidays

‘Tis the season to be jolly! Unfortunately, it’s also the season for scammers to go after your hard-earned dollars. Keep your money safe by reading up on the most common scams taking place this time of year.

Warming Hearts & Homes is Back. You Click. We Donate!

Community Financial Credit Union is excited to kick off the holiday season with the return of our 7th annual Warming Hearts & Homes charitable campaign! Throughout the month of December, Community Financial will donate up to $40,000 to local nonprofit organizations that provide heat, food, shelter and clothing to families in need.*

10 Restaurant Hacks to Save You Money

Dining out with family and friends is a wonderful experience, but it can take a huge bite out of your budget. No worries though, we’re not going to try convincing you to give up your favorite restaurant! Instead, use these restaurant hacks to trim your bill when dining out.

Manage Your Finances This Holiday Season

Have you made your gift list and checked it twice, but find that you’re still panicking about how you’ll pay for everything? Learn about your choices so you can spend responsibly and keep your holiday cheer all through the season. Here are some tips to keep your finances in control.

School Spotlight: Grand River Academy Students Learn Interviewing Skills

School Spotlight: Moraine SRCU Volunteers are Leaders!

School Spotlight: P-CEP Seniors Get Financially Ready for Real World

Go to main navigation

Go to main navigation

Fast Exit

The Senior Checklist

Mrs. La Forest asked questions like “What are the five factors that determine a person’s credit score?” and “What is the difference between using the credit option on a debit card vs. using a ‘real’ credit card?” Here are some pictures of Mrs. La Forest and two of her students in May with their completed “Senior Checklist!”

School Spotlight: Local High Schools Learn About Fraud

School Spotlight in the North: Students Take the $5 Bill Quiz

School Spotlight: Thornton Creek Students Practice Professionalism

School Spotlight: Liberty Middle School Students Get Schooled in “Adulting”

School Spotlight: Webster Elementary Students Learn Interviewing Etiquette Skills

About Community Financial

Checking & Savings

Business

Investments

Loans

Mortgage Services

Credit Cards

Student Services

eServices

Community

Member Services

Community Financial Credit Union

Visit One of Our 14 Convenient Locations