A Dose of Reality at Hillman High School

|

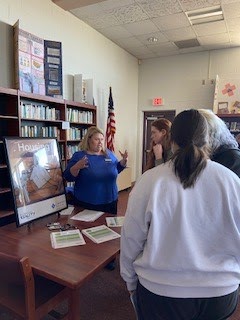

| Assistant Manager of the Atlanta Branch, Trena S, explains the selections on housing and making good financial choices. |

Hillman High School, in Montmorency County, recently teamed up with Community Financial to engage their students in a dose of financial reality! Hillman High School’s eleventh and twelfth grade students participated in a Community Financial sponsored “Reality Fair,” where students were asked to navigate the world of finances as adults!

The “Reality Fair,” developed by CUNA (The Credit Union National Association) and used by credit unions around Michigan, is designed to engage students in making money-smart adult choices. Students begin the Reality Fair by receiving a profession with a set salary and credit score. After students are taught about credit card debt, credit scores, student loan payments, and setting a monthly budget, they are tasked with choosing their transportation, housing, child care, home essentials, food, clothing, and more. The goal is for students to build a monthly budget within their set means, while simultaneously learning about the costs of necessary goods and services.

|

| Education Partnership Coordinator Angela C. shares that eating out all the time gets expensive. |

Preparing for Adult Life: Budgeting and Fraud Prevention

|

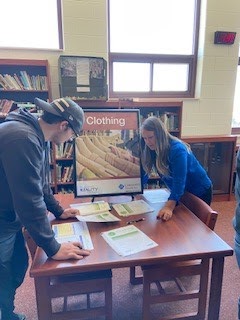

| Education Partnership Coordinator Julie B. helps at the clothing station. |

As Hillman High School students quickly realized, creating and maintaining a monthly budget as an adult requires making tough decisions. Luckily, through simulations like the “Reality Fair,” students learn the basics of making money-wise budget choices. For more information on how to create a budget, visit the My $ Manager tab on eBanking or the Mobile App, or visit our Financial Resources webpage for even more financial health tools today!

Along with detailed budgeting skills, teens (just like adults) need to recognize scams that target them. Teens are a common target group for fraud. It is easy for scam artists to take advantage of teens who are just learning to navigate the adult world on their own, especially with finances. Teens need to be leery of “too good to be true” deals. Scam artists can target teens and adolescents with emails and pop-ups that ask them to verify their social security number and/or account information. These scams often look legit and professional, so it is easy to be tricked into giving out personal information to the wrong people.

|

| Branch Manager Rick S. explains the importance of a good credit score and how it effects your ability to borrow and your interest rate. |

Other scams that teens fall victim to are scholarship and contest scams. Teens should be suspicious when being charged money for scholarship searches or contests asking for personal information. For more information on how to prevent fraud and identity theft, visit our Money Matter$ eLearning Center and complete the module on “Identity Protection.”

Looking for more information on how to get a Reality Fair presentation at your local school? Email our Assistant Manager/Community Relations, Mary Kerwin, at mkerwin@cfcu.org for more information about the Student-Run Credit Union program and the Reality Fair.

Your Turn: Which financial resources have helped you in creating and maintaining a budget? Share them with us in the comments!

« Return to "Money Matter$ Blog"