Tuesday, June 21, 2022 Unfortunately, too many people end up buying out each workday because they don’t realize how much it costs them, or they simply fail to plan ahead. Others may think it would be too much of a hassle to shop for, prep, and bring along lunch from home. Here are some hacks for brown-bagging it to work with all the savings and none of the hassle. Tuesday, July 20, 2021 Friday, February 21, 2020 Tuesday, February 18, 2020 Tuesday, February 11, 2020 Tuesday, July 9, 2019 About UsCareersBoard of DirectorsCommunity ImpactADA/ Web Accessibility CloseEnuff™ CheckingSavings AccountsMoney MarketsCertificates of DepositIRAsGrow Your Change Auto LoansBoat & RV LoansPersonal LoansBusiness LoansHome Equity LoansStudent LoansSkip-A-Pay PurchaseRefinanceFirst-Time HomebuyersMortgage Specialists Credit CardsCard Info & DisclosuresFraud Protection Youth ServicesStudent-Run CUGreenlightYoung Adult ServicesScholarshipsCloseEnuff™ Student Checking Community ImpactRelentless Care FoundationChoose The BearBlog Archive

Did you know that choosing to bring your own lunch to work each day can save up to $3,000 a year? Each takeout lunch can easily cost $12 more than a homemade meal. If you’d put that money into an index fund and contribute to it for 25 years, you could end up saving close to $500,000!

Did you know that choosing to bring your own lunch to work each day can save up to $3,000 a year? Each takeout lunch can easily cost $12 more than a homemade meal. If you’d put that money into an index fund and contribute to it for 25 years, you could end up saving close to $500,000!

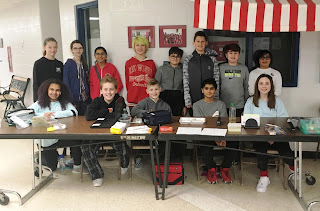

Hillside Middle School in Northville provides students with the continued opportunity to save their money at school with Community Financial’s Student-Run Credit Union program. Many students have been saving their money since elementary school at Thornton Creek, Amerman, and Moraine within the Northville School District.

Hillside Middle School Student-Run

Credit Union first semester volunteers

So, what are middle school students saving for these days? A phone, a down payment on a car, video games, college, and clothing are just a few examples. Although the list is wide-ranging, maintaining good money-saving habits during middle school is important for a student’s future financial success.

A budget will help you gain financial awareness, which will help facilitate more responsible decisions. Here are 6 easy steps to create a budget:

Step 1: Gather your financial information

Collect all your financial documents and receipts for three consecutive months. This includes all account statements, bills, pay stubs, receipts and more.

Where should you look for props?

You might think you’ve got a handle on your finances, but it’s likely you’re falling for at least one of these myths. Read on for 7 money myths that might be causing you more financial stress than benefit.

Myth #1: Debit is always better than credit.

P.O. Box 8050

Plymouth, Michigan 48170-8050

(877) 937-2328

2021(61)

December(5)

November(6)

October(5)

September(4)

August(5)

July(3)

June(6)

May(5)

April(5)

March(6)

February(6)

2020(61)

December(6)

All You Need to Know About Going Cashless5 Ways to Trim Your Fixed ExpensesBeware of Debt-Collection ScamsSchool Spotlight: Liberty Middle School and Financial Online Resources for Middle School Students3 Ways to Make Your Holidays Bright (and Safe!)9th Annual Warming Hearts & Homes: You Click, We Donate!

November(5)

October(5)

September(5)

August(4)

July(4)

June(6)

The Complete Guide to Prioritizing Bills During a Financial CrunchAll You Need to Know About Closing CostsSchool Spotlight: New School High Learns Real-Life Skills with the Student-Run Credit Union ProgramCreative Dine-In Cooking: Spaghetti PizzaWhy Is There Still a Shortage on Some Goods?Summer of Sharing 2020: 10 Years of Sharing

May(5)

April(5)

March(6)

February(5)

2019(62)

December(6)

Using 20/20 Vision in Your Financial New Year's ResolutionsStay Safe From These Airbnb Scams This WinterHow to Prepare Your Home for WinterSchool Spotlight: Bentley Elementary Students Benefit with the Student-Run Credit Union and Junior Achievement Programs6 Ways to Keep Your Finances Intact This Holiday SeasonWarming Hearts & Homes is Back. You Click. We Donate!

November(6)

October(6)

Save Money by Dining In | Butternut Squash and Chicken Chili5 Apps to Download Before the Holiday Shopping SeasonSchool Spotlight: Ridge Wood Elementary Teachers Engage Students in Financial EducationInternational Credit Union Day is October 17th!Making Banking Easier with an Updated Mobile App!Ways to Save on Food Costs in College

September(4)

August(4)

July(5)

June(5)

May(5)

April(6)

March(5)

February(5)

2018(63)

December(6)

4 Financial Resolutions for 2019 6 Financial Mistakes People Make in their 20's and How to Fix ThemSchool Spotlight: Local High School Students Learn About CreditMaking the Holidays Count When Home from College7 Naughty Scams to Watch Out for During the HolidaysWarming Hearts & Homes is Back. You Click. We Donate!

November(5)

October(6)

September(4)

August(5)

July(5)

June(5)

May(6)

April(5)

March(5)

February(5)

Save Big Bucks by Brown-Bagging Your Lunch

5 Steps to Take Before Making a Large Purchase

Have you been bitten by the gotta-have-it bug? It could be that popular exercise equipment that’s caught your eye, or maybe you want to spring for a new entertainment system, no matter the cost. Before you go ahead with the purchase though, it’s a good idea to take a step back and follow the steps outlined here to be sure you’re making a decision that you won’t ultimately regret.

School Spotlight: Hillside Middle School Students Continue to Save

How to Create a Budget in 6 Easy Steps

If you’re always wondering how you’re going to pay the next bill, feel guilty when you indulge in overpriced treats and you just can’t find money to put into savings, you might need a budget.

Create Your Own Photo Shoot

Professional pictures can cost a pretty penny, but captured memories are priceless. Have your pictures and your money, too, by creating your own photo shoot.

7 Money Myths You Need to Stop Believing

Most of us grow up hearing the same financial advice: spend less, save more, and invest early. While most of these words of wisdom ring true, there are lots of widespread money management tips that are actually false.

About Community Financial

Checking & Savings

Business

Investments

Loans

Mortgage Services

Credit Cards

Student Services

eServices

Community

Member Services

Community Financial Credit Union

Visit One of Our 14 Convenient Locations