School Spotlight: Gaylord Intermediate Students Set Savings Goals

|

| Gaylord Student-Run Credit Union winter volunteers. |

In our Northern communities, our school partners include: Gaylord Intermediate School, Lewiston Elementary, Atlanta Community and Hillman Elementary School. Gaylord Intermediate School has been a partner with us since 2004. Here are this winter's 6th grade Student-Run Credit Union volunteers from Gaylord Intermediate School!

Savings Goals…A Dream to Reality

Students who participate in the Student-Run Credit Union program are encouraged to keep track of their savings goals. Each student receives a “savings goal” sheet at the beginning of the school year, and tracks their progress on their goal sheet at each Student Credit Union deposit day.

It's great to see students come closer and closer to reaching their goals! Some students start with small goals, like purchasing a new book or game. Others dream bigger, by setting savings goals for college, a vehicle, or even a house someday!

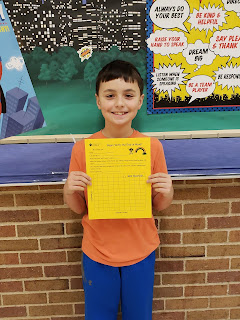

|

| A student member receiving his goal sheet! |

Creative Earning Ideas for Kids to Save Money

Students can get creative with how they earn money to reach their goals as well! Of course there are traditional ways of earning (like doing household chores). But creativity isn’t limited to chores alone. Students use their imaginations to come up with creative ways to earn income! Some examples include: teaching music lessons, making scrunchies, selling artwork, making friendship bracelets, selling yummy baked goods or even a neighborhood cleanup. With parent permission, students can reach their savings goals quite quickly, and creatively!

|

| Student volunteers wait to give prizes to those who met their goal! |

Savings habits needs to be acquired and practiced. Teaching your kids saving smarts now when they’re young can help make it a lifetime habit they’ve already mastered by the time they hit their 20s.

Your Turn: Do your kids spend their allowance, chore money and money they earn from odd jobs as soon as they have it? Or do they save up for larger purchases?

« Return to "Money Matter$ Blog"