School Spotlight: Looking Back and Moving Forward!

|

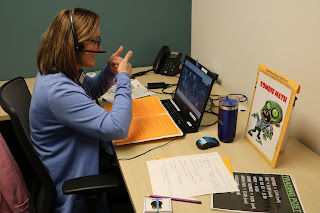

| Two thumbs up for Zombie Math! |

|

| Coordinator Amy Fava conducting a virtual Zoom presentation for Rosedale Elementary School students. |

Community Financial will continue this year to sponsor Banzai, an online financial education program for our partnering schools in Livonia, Belleville, Westland, Gaylord, Lewiston, Canton Preparatory High School, and New School High. With our sponsorship, teachers are able to teach the program free of charge, bringing easy-to-access financial education tools direct to the classroom. It also allows teachers to connect with our Education Partnership Coordinators if desired, for in-person or virtual presentations. We are excited to continue our partnership with the online financial platform Banzai, sponsoring the program for schools interested in online, financial scenarios and educational tools.

|

| Coordinator Julie Blaylock facilitating a virtual story time for students. "Arthur's Pet Business" is a favorite! |

Reality Fairs for Teens Also Resume

|

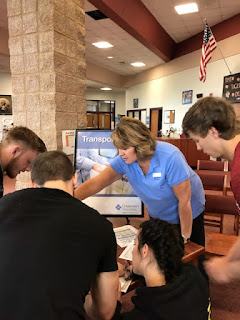

| Coordinator Michelle Richards helping a student calculate her monthly expenses. |

Last year, we made the Reality Fair a virtual or in-person simulation that could be done in a single class period, which allowed even more schools to host the event amid the pandemic and quarantine. We will continue to offer the Reality Fair

, both virtually and in-person, to high schools around our communities.

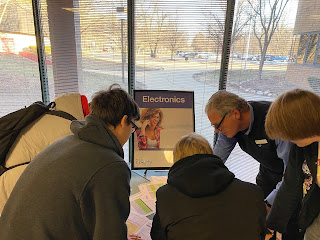

CEO Bill Lawton helping students understand

the concept of spending wisely.

Would you like more information about Community Financial's financial tools like the Reality Fair and Banzai? Please contact Assistant Manager/Community Relations, Mary Kerwin, at mkerwin@cfcu.org to get involved in your child's financial future today!

|

| “Adulting” can be harder than it looks! |

Your Turn: What are some ways in which you are moving forward with your finances in 2021? Share your plans with us in the comments!

|

| Remember, making good decisions is critical to financial success! |

« Return to "Money Matter$ Blog"